Council Tax to increase by 8.95%

Council Tax will increase 8.95% in 2025/26.

In brief:

- The Council had originally planned to increase Council Tax by 5.8% this year. However, it has now been confirmed by Government that only 60% of NI contributions will be funded and passed down to councils, therefore an increase of 8.95% is proposed to meet the unavoidable cost associated with changes to employee's national insurance contributions, particularly for health and social care services.

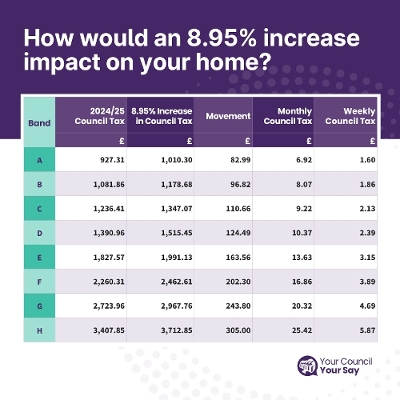

For a Band D property - a 8.95% increase in Council Tax amounts to an extra:- £124.49 per year

- £10.37 per month

- £2.39 per week

- An 8.95% Council Tax increase would cover the 40% shortfall in NI contributions and prevent a further £3 million of budget savings coming out of local services

- Council Tax would have to increase by 21% this year (2025/26) to offset the total budget gap that the council is facing - not the 8.95% increase which has been agreed

Leader of West Lothian Council, Lawrence Fitzpatrick said:

"To date, since 2007, the council has delivered over £172 million of savings and has had to endure 10 years of imposed Council Tax freezes.

"The 8.95 per cent increase in Council Tax was a difficult decision, but ultimately this was necessary to protect frontline services and make investing in communities a priority, whilst ensuring that the council remains financially stable. Council Tax would have had to increase by 21% this year to offset the total budget gap that the council is facing - not the 8.95% increase which has been agreed.

"That would not be sustainable for local residents but it does demonstrate the impact that insufficient levels of funding provided to councils has resulted in over the past decade."